#APPLE PAY GIFTCARD FREE#

If you’ve been around here long enough you know that I’m a HUGE fan of the free Ibotta app. See Also: What About Target? Can I Use Apple Pay? Clever Workaround: Use the Ibotta App to Pay with Apple Pay – Affirm – Affirm is a buy now, pay later service.

– Credit Card – Visa, MasterCard, Discover, American Express – Walmart Pay app – Add your credit, debit, or gift card to the app and you can use Tap Services at check out. The good news is Walmart DOES accept the following forms of payment: See Also: Walmart Return Policy: We Finally Explain It In a Way You’ll Understand What Payment Methods Does Walmart Accept?

#APPLE PAY GIFTCARD CODE#

If you shop regularly at Walmart, the Walmart Pay app is worth downloading and a decent alternative to Apple Pay.Įssentially you link your form of payment to the app and then use your phone to complete your purchase in-store.Īll you have to do is scan the QR code at checkout and not only will you pay quickly, but your eReceipt will be saved in case you ever need to make a return. See Also: 3 Walmart Receipt Must-Do’s That’ll Earn You Free Cash Is the “Walmart Pay” App Worth the Effort? So for Walmart, it’s more about the financial impact rather than appealing to consumers. Walmart uses MCX’s mobile payment system via Walmart Pay and thus avoids the 2% credit card fee that they would be hit with if they started accepting Apple Pay. The reasoning is because it would hurt the bottom line of Walmart’s income statement if they let shoppers use Apple Pay.Īccording to Business Insider, the reason Walmart won’t ever accept Apple Pay is because of a contractual obligation to Merchant Customer Exchange (MCX).

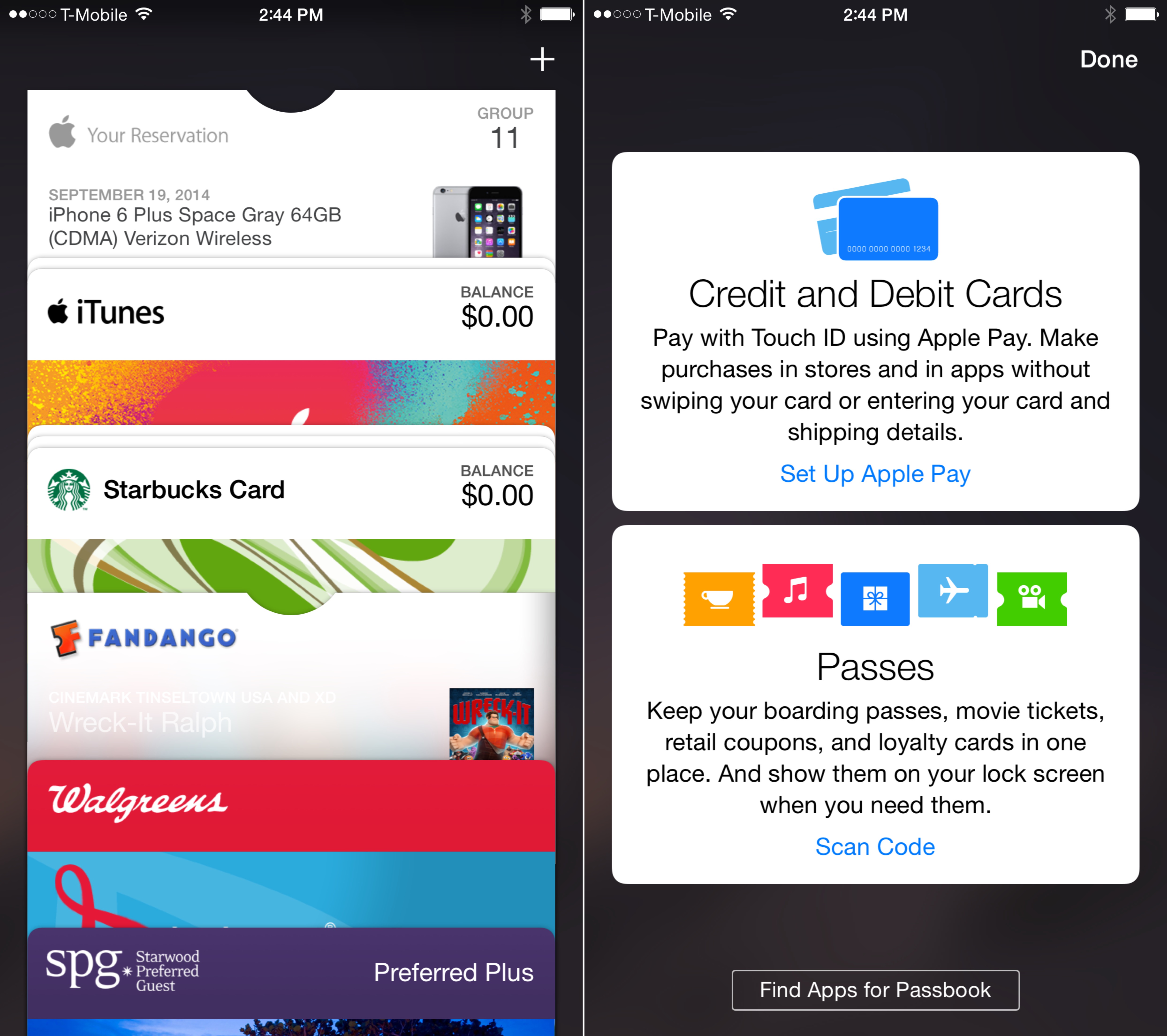

Will Walmart Accept Apple Pay in the Future? Walmart does not currently accept Apple Pay as a form of payment, either in-store or online.īut…keep reading as I have a clever workaround that’ll let you use Apple Pay when shopping in-store at Walmart. But does Walmart take Apple Pay? Or are you stuck using the Walmart Pay app or a regular ol’ credit card? Let’s break it all down. Nothing more convenient then just pulling out your iPhone and paying instantly at checkout…heck, you don’t even need to bring your wallet to the vast majority of stores these days. By charging a card or digital wallet, your money is not sent to N26 instantly, and the fee covers additional costs associated with funding accounts before the money is received so that it is instantly available for your use.If you consider yourself an Apple fanboy (or girl), you’re probably a HUGE fan of Apple Pay. Whilst this is the fastest and easiest way to instantly add funds in your N26 account, for us, processing these instant top-up transactions is more expensive than other account funding methods (new tab) we offer.įor both methods, the first deposit is always free but extra deposits are charged a fee of 3% of the deposit amount. To find out more about the difference between debit, credit and prepaid cards read this article (new tab).

0 kommentar(er)

0 kommentar(er)